Successfully investing in the financial markets requires a well-defined approach. Traders must analyze market trends, assess their risk tolerance, and formulate a portfolio that supports their objectives. Established investment methods, such as shares, debt securities, and pooled investments, remain prevalent. However, innovative asset classes, like cryptocurrencies, are accumulating traction among experienced investors seeking exposure. It is crucial to undertake thorough analysis before committing capital and to regularly review portfolio performance.

Cracking Personal Finance for Millennials

Personal finance appears to be a daunting jungle to millennials. Juggling financial obligations with ambitious life aspirations, it's easy to feel overwhelmed of your financial well-being. But don't panic! Taking control of your finances is a journey, not a race.

Start by building a realistic budget that records your income and expenses. Explore saving strategies to grow your wealth. Educate yourself from experts in the field to make informed decisions.

Remember, financial literacy is a valuable tool that will guide you throughout your life.

Compounding's Influence

Building long-term wealth requires a strategy that embraces patience and consistency. One of the most potent tools at your disposal is compounding, a phenomenon where profits generate additional profits, creating a snowball effect over time. By saving wisely and allowing your assets to mature, you can unlock the remarkable opportunity of compounding to achieve your financial aspirations.

- Initiate early: The sooner you start, the more time your money has to accumulate

- Allocate your investments: Don't putting all your eggs in one basket. Explore diverse asset classes to reduce risk and boost returns.

- Remain consistent: Market fluctuations are inevitable. Avoid emotional choices and stick to your financial plan.

Comprehending copyright and Blockchain Technology

copyright has risen as a cutting-edge financial innovation. At its foundation lies blockchain technology, a distributed ledger that stores all transfers in a secure manner. Each block on the chain encompasses a group of transactions, which are linked together cryptographically, verifying their authenticity and integrity. This structure makes copyright resistant to tampering and allows for peer-to-peer transactions without the need for a central authority.

Additionally, blockchain technology has the potential to revolutionize many domains beyond finance, such as supply chain management. Its distributed nature can improve accountability and streamlining. As copyright and blockchain technology continue to develop, their influence on society is likely to be profound.

Gaining Control of Your Finances: An Actionable Plan

Embark on the journey to abundance by adopting a robust financial plan. This comprehensive guide will empower you with the knowledge and tools necessary to manage your finances effectively. Start by assessing your current standing, identifying your objectives. check here Then, develop a plan that integrates strategies for saving wealth, controlling debt, and safeguarding your future.

- Establish a Budget: Monitor your income and expenses to gain a clear understanding of your financial flow.

- Outline short-term and long-term objectives, such as acquiring a home, ceasing work, or supporting your children's education.

- Diversify Your Investments: Explore various investment options to minimize risk and maximize returns.

- Protect Yourself with Insurance: Obtain adequate coverage for health, property, and liability to safeguard against unforeseen events.

Conquering the Secrets to Debt Management

Embarking on a journey to control debt can feel overwhelming, but, it's a crucial step towards financial freedom. The key lies in developing a strategic plan that targets your individual circumstances. Initially creating a detailed budget that analyzes your income and expenses. This, identify areas where you can cut back. Investigate debt management options to minimize interest rates and monthly payments. Furthermore, prioritize establishing an emergency fund to protect you from unexpected situations.

- Consult to a financial advisor for personalized guidance.

- Persist focused to your debt reduction plan.

- Celebrate your successes along the way to enhance motivation.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Amanda Bearse Then & Now!

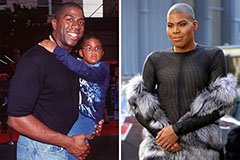

Amanda Bearse Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!